|

|

|

|---|

|

|

|

|---|

|

|

|---|---|

|

|

|

|

|

|

|

|---|

Obtain My Credit Report: A Comprehensive Guide for Consumers

Understanding your credit report is essential for maintaining your financial health. This guide will walk you through how to obtain your credit report, the benefits of doing so, and what to look out for.

Why You Should Obtain Your Credit Report

Regularly checking your credit report can help you monitor your financial standing and catch any inaccuracies or fraudulent activities.

- Track Your Financial Progress: Keeping an eye on your credit report helps you track improvements in your credit history.

- Identify Errors: Mistakes in your report can affect your credit score. Reviewing your report allows you to dispute inaccuracies.

- Prevent Identity Theft: Regular monitoring helps you detect unauthorized activities early.

How to Obtain Your Credit Report

Requesting from Major Credit Bureaus

You are entitled to one free credit report annually from each of the three major credit bureaus: Experian, TransUnion, and Equifax. Visit check my credit report for detailed instructions on requesting your report.

Online Services and Apps

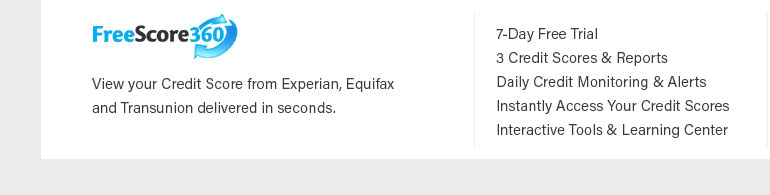

Several online platforms and mobile apps offer access to your credit report and score. These services often provide additional insights into your credit reports and scores.

Understanding Your Credit Report

Your credit report includes several key components that are crucial to understand:

- Personal Information: This section contains your name, address, and social security number.

- Credit Accounts: Details about your credit cards, loans, and payment history are included here.

- Credit Inquiries: Lists the entities that have requested your credit report.

- Public Records: Any bankruptcies, foreclosures, or other public financial records.

Frequently Asked Questions

How often should I check my credit report?

It is recommended to check your credit report at least once a year, or more frequently if you suspect any suspicious activity.

What should I do if I find an error on my credit report?

If you find an error, contact the credit bureau immediately to dispute the information. They are required to investigate your claim.

Will checking my credit report affect my credit score?

No, checking your own credit report is considered a soft inquiry and does not impact your credit score.

By understanding and monitoring your credit report, you can take control of your financial future and make informed decisions about your credit and financial health.

Right now, the three nationwide credit bureaus let you get a free report online once a week. Get your free weekly report from ...

The fastest way to obtain a credit report is online. Visit the AnnualCreditReport.com website to immediately view your credit report.

Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and ...

![]()